Empowering Futures with Candour Asset Management LLP

BUILD WEALTH WITH RIGHT INVESTMENTS

Buy quality businesses at reasonable valuations and hold till the company executes.

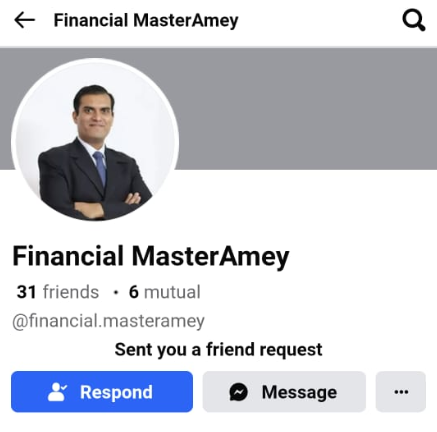

Amey Kulkarni

SEBI Registered Investment advisor

Welcome To Candor Investing

Focus & Experience Combined

Amey is a full-time investor and founder of Candor Investing – a SEBI registered investment advisory.

Before turning a full-time investor, Amey has worked for 9+ years in corporates like L&T, Jindal Steel and Siemens Ltd.

He is an electrical engineer and an MDI Gurgaon alumnus.

He also actively contributes to the investing community with his research and talks. You can follow him on twitter where he shares his thoughts and ideas.

15

Years Of Experience

15

NRI Clients

140

No of Clients

We live by a simple principle when it comes to stock market investing...

Buy quality businesses at reasonable valuations and hold till the company executes.

Amey Kulkarni

Designated Partner

SEBI Registered Investment Advisor

Welcome To Candour Asset Management LLP

Focus & Experience Combined

Amey is a full-time investor and founder of Candour Asset Management LLP – a SEBI registered investment advisory.

Before turning a full-time investor, Amey has worked for 9+ years in corporates like L&T, Jindal Steel and Siemens Ltd.

He is an electrical engineer and an MDI Gurgaon alumnus.

He also actively contributes to the investing community with his research and talks. You can follow him on twitter where he shares his thoughts and ideas.

15

Years Of Experience

15

NRI Clients

200

No of Clients

We live by a simple principle when it comes to stock market investing...

Our Services

Stock Portfolio Advice That Simply Works For You

Lets Become Wealthy Together

- Personalized Portfolio

- Strategic Asset Growth

- Dedicated Expert Guidance

- Understanding Your Financial Goals

- Existing Investments Review

- Customized Strategy Development

- Tax Efficiency and Risk Aversion

- Comprehensive Learning

- Safeguard Your Investments

- Learn at Your Own Pace

Integrity

Do the right thing for the customer. Customer relies on us for appropriate advise. Fulfil that responsibility

Focus

Do not get distracted from mission. Focus on organisation mission - CAGR Returns

Excellence

We don't aim for the average. You can and should invest in index funds. We aim for extra-ordinary results

Simplicity

When it comes to your investments, a simple approach gives better results compared to complex / exotic solutions

About Candor

Build Wealth With Stocks

Do the right thing

Stock Investing

The Magic, Myths And Mistakes

Media Articles & Videos

April 8, 2025

Amey Kulkarni at Asian Investing Summit 2025 - Suryoday SFB Analysis

By Amey Kulkarni

May 27, 2023

INOX Wind: When promoters put in money in troubled business, it calls for deeper look

By Amey Kulkarni

April 8, 2022

Amey Kulkarni at Asian Investing Summit 2022 - Wonderla Holidays Analysis

By Amey Kulkarni

Testimonial

Reviews From Our Investors

I started with some hesitation but Amey’s approach is all about focus, keeping yourself grounded and think long term. It has paid off for me.

Bajaj Finance, Pune

My portfolio is doing much better than what I tried to do myself. Conversations with Amey are enlightening. Love the detailed analysis too.

TCS

I was unsure at first, but Amey's strategy of focusing on long-term gains and staying disciplined has truly transformed my investment outlook. I am now more confident in my financial decisions.

Director, Jagir Jhaveri Jewels

Amey has been an exceptional asset in my portfolio. Sarvesh plays an important role.

Branch Vertical Head, BCCL (The Times of India)

Amey demonstrated a profound understanding of investment strategies possesses an outstanding depth of Market research skill. I couldn't be more satisfied with the experience.

Ex-Defence, India

Have been with Amey for four plus years. His calm approach to the market is striking. He rarely gets excited or anxious about the short term and focusses on the fundamentals.

Blog & Articles

Stay Updated By Exploring Further Our Blog

Our blog covers a wide range of topics to help you navigate the ever-changing financial landscape. Whether you're a seasoned investor or just getting started, our articles provide valuable information to make informed decisions

When profits of the company go up, stock prices go up and vice versa.

Alignment of the advisor and the investor is paramount to successful investing.

You may avail our advisory services only if you have a 5+ yr investment horizon.

Investing is not physics and there are not fixed laws.

Investing is a game of probability.

Stock markets are always either overvalued or undervalued and rarely fairly valued.

The two most important behaviour traits for the investor are

- Contrarian behaviour

Be greedy when others are fearful and be fearful when others are greedy

Invest more during bear markets and be cautious during bull markets - Patience Long-time horizon

Help Center

Navigate the Unknown FAQs as Your Guide

Need More Questions?

We're here to help. Contact us for more information.

Varun Rajkumar

Cognizant, US